Importing Accounting Data into ATX

Accounting data exported from CAS or iFirm may be imported into ATX and the amounts will flow to the activities mapped during the export from CAS or CCH iFirm . It is not necessary to add activities to the tax return prior to the import. If the required forms do not yet exist in the return, they will be added during the import process.

To import accounting data:

- Open your client's tax return in ATX.

The SSN or EIN must already be entered.

- Click the Returns menu; then, expand the Accounting Import fly-out menu and select Client Trial Balance, Client Write-Up or iFirm Trial Balance.

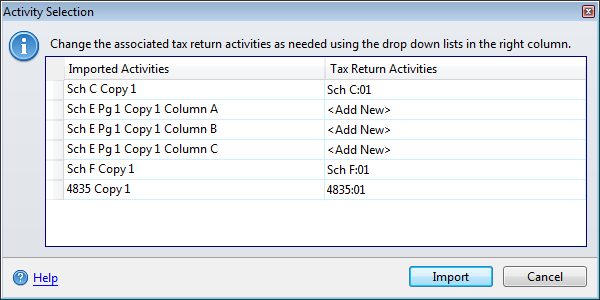

Activity Selection dialog box

If the file has been saved to another location during export, you will see a browse dialog box. Simply browse to the export file, then click Open, then the Activity Selection dialog box will appear.

The Imported Activities column lists each activity to be imported. The Tax Return Activities column shows the form(s) to which data will be imported. <Add New> signifies that the form will be added during the import process.

- Click Import to complete the process.

The Import Progress... dialog box appears, followed by the Import Results dialog box.

All necessary forms have been added to the return and totals have been imported to the mapped tax lines.

See Also: